Property Assessment Overview

Minnesota state law requires properties to be physically inspected at least once every five years. Inspections typically occur in the Summer and Fall. The appraiser will request to view the interior of the property to observe the amenities and determine the condition and quality of each property. This review will also help to determine the use of the property.

Assessments are completed by county appraisers who are licensed by the State of Minnesota.

What does an assessor do? (video)

How value increases affect my taxes (video)

Assessment Process

There are two main steps in the assessment process:

- Property Valuation – Each year property is valued as of January 2. The appraisers and assessor collect information on each property and review recent sales activity in the county to determine property values.

- Property Classification – Each year, property is classified as of January 2. Minnesota state law provides a list of possible classifications and the assessor and appraisers classify each property based on the use of the property.

Find Parcel / Property Information

Information on Houston County properties is available on the Beacon website. This website provides land and building information, sales information, valuation statements, tax statements, and aerial photography for all types of property in the county. You can search by name, address, or parcel ID.

Questions or Concerns

The Houston County Assessor’s Office certifies assessments annually. If you have any questions, please call (507) 725-5801.

Messages from the Assessor

Last updated – March 2025

2026 Valuation Notices and Property Value Changes for Houston County

Residents of Houston County can expect to receive their 2026 property valuation notices beginning in early April. These notices will arrive alongside your 2025 tax statement, in a separate color, as an additional page. It's important to review these notices carefully, as this is the time to check for any discrepancies or changes in your property's valuation.

Keep in mind, questions about the 2025 tax amounts or any tax changes should have been addressed last fall. The 2026 valuation statements will also indicate any class and homestead changes, as well as the time and date of the local board of appeals meeting for your city or township. If there is no local meeting scheduled, the statement will note "Open Book," which means your appeal process will occur at the County Board of Appeals meeting in June. The assessor's office is always your best resource for any valuation questions.

Understanding the Valuation Process

Minnesota law requires assessors to value properties based on sales from the previous year. The sales study for 2026 values was based on sales between October 1, 2023, and September 30, 2024. This is a key period to keep in mind when reviewing your valuation statement. For the upcoming year, the housing market in Houston County has largely stabilized, and if the trend continues through the next sales period (October 1, 2024, to September 30, 2025), it may impact the 2027 valuation notices.

Additionally, Minnesota law mandates that assessors apply a "time trend" to account for any changes in sale prices since the time of the sale. The state determines the rate at which property values have increased over the course of the sales study and applies that rate to each sale, adjusting it to January 2 of the year for which the values are being set. For 2026, the Houston County Assessor's Office successfully appealed the state's 19% time trend, believing it did not reflect the current market conditions. The state agreed, resulting in a significantly lower increase in property values for the county.

2026 Value Changes in Houston County

Countywide Increases:

• Steel Utility Buildings: $2.15/sqft

• Basement Finish: $3.00/sqft

• Fireplace: $300 to $900 (depending on style)

• Garage Finish: 5%

• Average Bathroom: $1,600/bathroom

• Two-Story Houses: 8%

• Garage Doors: $3,800 (previously $500)

• Electric only Sites +5,000/ Site

Additional Increases by Township & City:

• La Crescent Township: 5%

• Union Township: +10%

• Black Hammer Township: +10%

• Caledonia Township: +10%

• Houston Township: +15%

• Crooked Creek Township: +5%

• Hokah Township: +20% (excluding certain neighborhoods)

• Brownsville City +15%

• Marina Dr +15%

• La Crescent City + 13%

• Eitzen City + 15%

• Shore Acres + 15%

• Horse Track +5%

• Horse Track Twin Homes +5%

• La Crescent 2 Story Condos +10%

• Wildwood Townhouses + 10%

• Wilmington Township +5%

• Yucatan Township +15%

• Green Acres Addition +20%

• Sunset Addition +10%

Decreases in Value:

• Fox Chase Addition: -10%

• Fox Shadows Addition: -10%

• Wagners Addition: -10%

• Brookwood Addition -10%

• River Terr Addition -10%

• Money Creek Township: -10%

• Valley High Addition: -5%

• Money Creek Twp -10%

• Mound Prairie Twp -15% (not Valley High)

• Valley High Addition -5%

• Unfinished Basements -5%

• Ag Site Acres -1000/acre

Land Value Changes:

• Tillable Land (100 CER rating): $10,300/acre (up from $10,000)

• Woods: $5,700/acre (up from $4,200)

• Pasture: $3,600/acre (up from $3,000)

• Eitzen City Lot +$65/Front Foot

• Green Acres Addition + $50/Front Foot

• La Crescent City Residential Land Along Hwy 6, +13%

• Shore Acres Site +$5,000/Site

Quintile Review Process

The Assessor’s Office conducts a "Quintile" review each year, reappraising 20% of properties across the county. This ensures that individual property characteristics are considered, beyond the mass valuation based on sales studies. Homeowners can assist by providing accurate information during the Quintile review process, which is essential for an accurate property value assessment.

This year, the following areas will undergo Quintile reviews starting in May:

• Spring Grove Township

• Spring Grove City

• Caledonia City

• Black Hammer Township

• One-third of La Crescent City

When an assessor visits your property, they will ask about your home and any outbuildings. If allowed, they may also inspect the interior. Homeowners are encouraged to cooperate with these reviews, as failing to do so may result in inaccurate assumptions about your property’s value.

Conclusion

It is essential for property owners to carefully review their 2026 valuation notices and participate in the Quintile review process. Providing accurate property information ensures that your property is valued fairly and accurately, and that you are not overpaying or underpaying your taxes. If you have any questions about your valuation, the Assessor's Office is the best place to start.

Look out for the Yellow Call Back Cards if you are part of the Quintile review areas this summer. We also offer an online option to respond to questions for you convenience.

Previous Messages from the Assessor

Land Value Changes for 2025 - March 20, 2024

Title Lock Insurance Scam - January 30, 2024

Regarding Your 2024 Proposed Taxes - December 11, 2023

Homestead Notice - November 16, 2023

Houston County Assessor Loses Appeal on Agricultural Values - July 13, 2023

2024 Valuation Notices - March 13, 2023

Buying or Selling Land Currently Enrolled in a Land Program - September 25, 2022

Disaster Relief for Storm Damage - July 25, 2022

Application for Local Option Disaster Abatements and Credits - July 25, 2022

Map of 2022 Value Increase and Land Values by Type - March 16, 2022

2022 Value Increases for 2023 Taxes Payable - March 15, 2022

Homesteads

In Minnesota there are two main types of homesteads: residential homesteads and agricultural homesteads.

A residential homestead is for property owners that live on non-agricultural land. They own and occupy their residence, or have a qualifying relative that occupies a residence they own. This may qualify the owner for a homestead exclusion which could lower their taxes (see below).

An agricultural homestead is for people who live in a home on, or connected to, agricultural land that is farmed. In order to receive an agricultural homestead you must be a Minnesota resident, live in a residence on agricultural land (in most cases), or you must farm agricultural land that is within 4 townships or cities of where you live. An agricultural homestead can reduce the taxable class rate of your agricultural land up to a certain total value limit. Agricultural homesteads are also eligible for an agricultural homestead credit of up to $490. The state of Minnesota only allows 1 agricultural homestead per property owner.

Qualifying for Homestead Market Value Exclusion

To qualify for a homestead exclusion you must own and occupy the property as your primary residence. Some residents may qualify for a relative homestead (see below).

You must occupy the residence and apply with the county assessor’s office on or before December 31 to qualify for taxes payable the next year. In most cases, the owner must also be a Minnesota resident.

Once granted homestead classification, your homestead will remain until you sell the property or you notify our office. If you are no longer occupying the property, you are required to notify our office within 30 days. Please call (507) 725-5801 or send an email.

Tax Reduction

Receiving homestead classification on your residential property may reduce the taxable value of your property up to $38,000 depending on the value of your property, which results in the possibility of reducing your taxes. Click here for more information on how your homestead market value exclusion is calculated.

Agricultural homesteads may receive a credit up to $490 on your tax bill, thus reducing your overall taxes payable. Click here for more information on how your agricultural homestead market value credit is calculated.

Applying for Homestead

It is the owner’s responsibility to ensure a property that is eligible for homestead is receiving it. Our office will send applications when a property transfer occurs, or if we are verifying that a property continues to qualify.

Your current homestead status is noted on your Valuation Notice in the Spring.

To apply for homestead, please complete the appropriate form and mail it to us, or return it to our office. If you would like an application mailed to you, please call our office.

Houston County Assessor

304 S. Marshall Street, Room 203

Caledonia, MN 55921

(507) 725-5801

Applications

Below are applications for Special Agricultural Homestead. To qualify, the applicant farms the land and lives within four cities or township. Please complete the application that best describes your ownership type.

- Special Agriculture Homestead – Individual Owned

- Special Agriculture Homestead – Entity Owned

- Special Agriculture Homestead – Trust Owned

Qualifying Relatives for Homestead

If you own a property that a relative lives in, that property may also qualify for homestead. For residential property, these relatives include the following:

- Child

- Stepchild

- Parent

- Stepparent

- Grandchild

- Grandparent

- Brother

- Sister

- Uncle

- Aunt

- Niece

- Nephew

Special Homestead Programs

There are other special programs available, including a homestead for qualifying disabled veterans, and for owners or occupants who are blind or permanently disabled. Please visit our special programs page or call our office for more information: (507) 725-5801.

How Property Taxes are Calculated

Your property tax bill includes local and state property taxes. Local property taxes fund local programs and services, such as public schools, fire and police protection, streets, libraries and more. State property taxes fund school districts, towns, cities, counties, and other special taxing districts.

Yearly property taxes depend on these factors:

- Tax levy (county, city/township, and school)

- Value (estimated market value) and classification of the property

- Tax credits or programs that may reduce the tax due

- Additional school taxes (referendums) or state property taxes that apply to certain properties

Who sets the levies?

County tax levy is set by the Houston County Board of Commissioners.

Local tax levies are set by the city/township board members.

School tax levies are set by each school district (Houston, Spring Grove, Caledonia, or La Crescent).

Who sets the value and classification of your property?

The county assessor sets the value and classification for each property.

The value and classification are used to determine your share of the levy.

Who calculates property taxes?

The county auditor calculates the tax due for each property in the county.

What formula is used to calculate property taxes?

- Taxable Market Value × Class Rate = Net Tax Capacity

- Net Tax Capacity × Local Tax Rates = Base Tax

- Base Tax − Credits + Referendum Levy and State General Tax = Property Tax Due

GLOSSARY OF TERMS:

Base tax

At the most basic level, there are two types of bases upon which property taxes are levied in Minnesota: net tax capacity and referendum market value.

Class rate

The percentage rate assigned to a particular classification of property. For example, the class rate for residential non-homestead properties was 1.25% for 2026. Click here to see the 2026 classification rates for taxes payable in 2027.

Classification

The classification of your property refers to how the property is used. Different classifications include residential (homestead or non-homestead), agricultural (homestead or non-homestead), seasonal recreational residential, commercial, industrial, rural vacant, or exempt. Each classification has its own class rate.

Local tax levy

The local tax levy is the budget calculated by counties, cities, townships, and schools. The levy is the total annual dollar amount needed to fund programs and services for the entire community.

Local tax rates

Local levy totals divided by the total estimated market value of all taxable properties within the city/township.

Net tax capacity

Taxable Market Value × Class Rate = Net Tax Capacity

Referendum market value

For residential properties the referendum market value equals the estimated market value multiplied by the referendum rate (determined by the referendum levy).

For agricultural properties the referendum market value equals the value of the HGA (house, garage, and 1 acre) multiplied by the referendum rate (determined by the referendum levy).

Tax credits or programs that may reduce tax due

Here are some examples of programs that reduce taxes due: property tax refund program, market value exclusion for disable veterans, senior citizen property tax deferral, green acres program, rural preserve program, etc.

Taxable market value

This is the value your property taxes are actually based on. It is the estimated market value minus any exemptions or special programs.

Value

The value is the estimated market value of your property which is what the assessor estimates your property would likely sell for on the open market.

How to Appeal an Assessed Value

Estimated market value

The estimated market value of a property is the amount the assessor estimates a buyer would pay for a property if it were offered for sale. Each year the assessor reviews the market valuation of your property to determine if changes in the real estate market or improvements to properties require a change in the estimated market value.

Classification and class rate

All property is classified by the assessor according to its use. Each class of property (residential, agricultural, seasonal recreational residential, commercial, industrial, etc.) may be taxed at a different percentage of its value. This percentage, or class rate, is determined by the state legislature. Like market value, the class rate of your property plays a significant role in how much property tax you pay.

Valuation notice

Each spring, the assessor will mail you a Valuation of Real Property Notice, informing you of the value and classification of your property. If you believe the classification or the estimated market value of your property is incorrect, you have several appeal options.

The first step is to verify that the information your assessor’s office has listed about your property is correct. Most of this information is public and available to you on the Beacon website.

- Verify information about your property, such as its dimensions, age and condition of its structures, etc.

- Review records to determine the market value of similar property in your neighborhood

- Review sales data to find out what similar property in your area is selling for

- Check real estate websites to get an idea of the asking price of local properties

If, after researching your property’s information, you still feel the value or classification is incorrect, the next step is to reach out the assessor's office to discuss your concerns.

Houston County Assessor’s Office

304 S. Marshall Street, Room 203

Caledonia, MN 55921

Email

(507) 725-5801

Appealing your assessment

You have the right to appeal your market value estimate and/or property classification if you feel your property is:

- Classified improperly

- Valued at an amount higher than you could sell your property for

- Valued at a level different from similar properties in your area

First, meet with the assessor to discuss changing your assessment. If you and the assessor are unable to agree on your valuation or classification, more formal methods of appeal are available.

You can appeal to your local and county Boards of Appeal and Equalization or attend the open book meeting if your local taxing district no longer has a local Board of Appeal and Equalization. You can take your appeal directly to the Minnesota Tax Court. Or you can choose both options, in which case you must begin with the local Board of Appeal and Equalization.

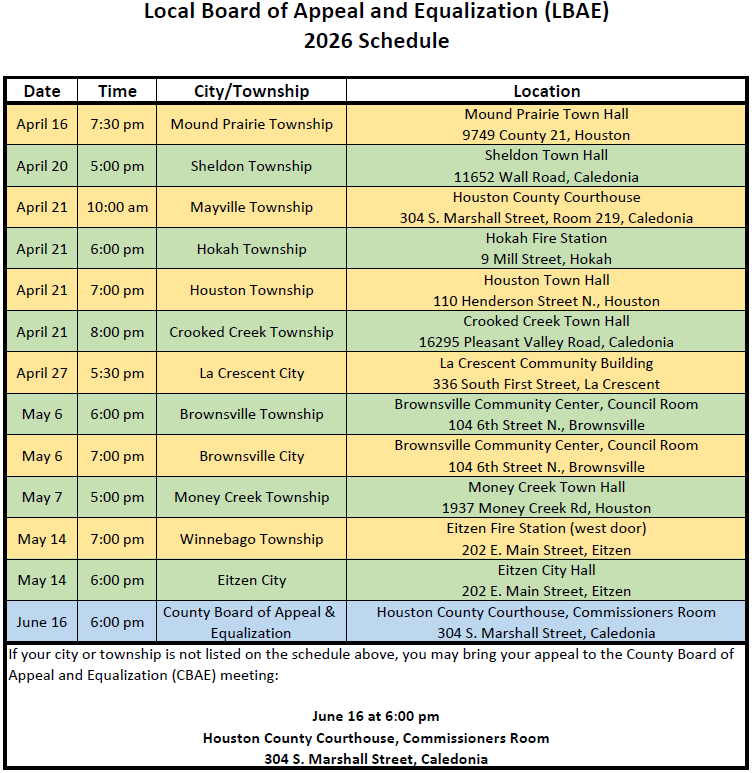

Local Board of Appeal and Equalization (LBAE)

If you choose to appeal to your local boards, first meet with your City or Town Board of Appeal and Equalization. These are usually the same people as your city or town council. The board meets on a specified day in April or May. The exact date is listed on your Valuation of Real Property Notice. We strongly recommend that you call the Houston County Assessor's Office at (507) 725-5801 to schedule an appointment. You may make your appeal in person, by letter, or have someone else appear for you. The assessor will be present to answer questions.

You must present your case to the city or town board before going to the County Board of Appeal and Equalization.

County Board of Appeal and Equalization (CBAE)

If you are not satisfied with the decision of the city or town board, you may appeal to the County Board of Appeal and Equalization. You must present your case to the city or town board before going to the County Board of Appeal and Equalization. This board meets in June. The exact date is listed on your Valuation of Real Property Notice. The members are the County Board of Commissioners and the Auditor/Treasurer. We strongly recommend that you call the Houston County Assessor's Office at (507) 725-5801 to schedule your appearance before the board. You may make your appeal in person, by letter, or have someone else appear for you. The assessor’s office staff will be present to answer questions.

If you are not satisfied with the decision of the County Board of Appeal and Equalization, you may appeal to the Minnesota Tax Court.

Minnesota Tax Court

You have until April 30 of the year the tax becomes payable to appeal your assessment to the Minnesota Tax Court. In other words, you must appeal your 2024 valuation and classification on or before April 30, 2025.

The Tax Court has two divisions, Small Claims Division and Regular Division. The proceedings of the small claims division are less formal and many people represent themselves. Decisions made by the small claims division are final and cannot be appealed further.

The regular division will hear all appeals-including those within the jurisdiction of the small claims division. Divisions made here can be appealed to a higher court. Most people who appeal to the regular division hire an attorney because the hearing is conducted according to the Minnesota rules of civil procedure.

You may obtain complete information on Minnesota Tax Court appeals by contacting:

Minnesota Tax Court

245 Minnesota Judicial Center

25 Rev. Dr. Martin Luther King, Jr. Blvd.

St. Paul, MN 55155

(651) 539-3260

(651) 297-8737 (fax)

Email

Tax Abatements

Overview

Tax abatements are a method for adjusting a property’s taxes by changing the market value or classification associated with that property. These changes are made to correct clerical errors that were not discovered until the taxes were billed.

A tax abatement is a formal, written request, made to Houston County. Tax abatements cannot be used to replace the normal appeals process. The normal appeals process begins when Valuation of Real Property Notices are mailed. These notices are mailed out every Spring. For more information on appealing your property’s value or classification, click here.

How to File an Abatement

To request a tax abatement visit the Houston County Assessor’s Office at 304 S. Marshall Street in Caledonia, or call 507-725-5801 for more information. You must complete and sign an Application for Property Tax Abatement to begin the abatement process.

Your application for abatement must then be approved by the County Assessor, County Treasurer, and the Houston County Commissioners. This may take 6–8 weeks, or longer in some instances.

When to File an Abatement

Abatements are filed in the year the taxes are due, in most cases. They can be filed for an additional two-year period if the applicant can prove a clerical error was made, or if there was a valid hardship that prevented the owner from appealing sooner. A clerical error is typically a data entry or mathematical error.

Damaged or Destroyed Property

If your property’s buildings have been unintentionally or accidentally destroyed due to a natural disaster, or destroyed due to arson or vandalism by someone other than the owner, you may be eligible for property tax relief through an abatement. Contact the Assessor’s office to request this application: 507-725-5801.

Special Programs

Tax Reduction or Credit Programs

There are numerous special programs that affect the amount of property taxes certain properties pay. They may reduce the values used to calculate taxes or they may actually be credits or refunds of property taxes paid. Each has its own set of requirements and most require an application to be completed. Please review the information below and contact us at (507) 725-5801 if you have any additional questions.

Property Tax Refund Program (PTR)

The PTR is a statewide program where certain taxpayers are eligible for a refund of some of their property taxes based on their household income and the amount of taxes they paid. Visit the Minnesota Department of Revenue’s website for more information.

Market Value Exclusion for Disabled Veterans, Primary Family Caregivers

& Surviving Spouses

This program provides a market value exclusion for property tax purposes for the homestead property of qualifying veterans and surviving spouses or primary family caregivers of qualifying veterans. Get more information or contact Houston County Veteran’s Services: 507-725-5805.

Class 1b Blind/Disabled Homestead

This program provides a reduced tax rate for homestead property of any person who qualifies as blind or as permanently and totally disabled. Get more information. | Application

Senior Citizen Property Tax Deferral

This program may help qualifying seniors who are having difficulty paying their property taxes by limiting property taxes to 3% of income. The state provides a loan for the difference. Age, income, and other requirements will apply and loan repayment, plus interest, will be required. Get more information.

Land Owner Programs

Green Acres

This program provides property tax relief for owners of agricultural property in areas where the market value of land is being affected by development pressure, sales of recreational land, or other non-agricultural factors. Get more information.

Rural Preserve

This program provides property tax relief for qualifying owners of rural vacant land in areas where the market value of the land is being affected by development pressure, sales of recreational land, or other factors. Get more information.

Class 2c Managed Forest Land

This property classification provides a reduced class rate of 0.65% to forested property that is subject to a current forest management (stewardship) plan and that meets other requirements. Get more information.

Sustainable Forest Incentive Act (SFIA)

This program provides incentive payments to property owners to encourage sustainable use of forest lands. The enrolled land must remain in SFIA for at least 8, 20, or 50 years depending on the length of their recorded covenant (agreement). Get more information.

Exempt Property

Tax Exempt Properties

As a general rule, all property in Minnesota is taxable, unless the property is owned and used for qualifying exempt purposes.

The following is a partial list of common property types that may qualify for exemption from property taxes. Other possible exemptions are listed in state law.

- Academies, colleges, and seminaries of learning

- Churches, church property, and houses of worship

- Institutions of purely public charity

- Manure pits certified by the MPCA

- Nursing homes

- Public schools, hospitals, and burying grounds

- Public property used exclusively for public purposes

Property receiving exemption from property taxes may still be required to pay for special assessments or other services and, in some instances, makes a payment to governments in lieu of the property tax.

Applying for Exemption

Organizations seeking exemption must file an exempt application for each parcel that may qualify. In order to receive exempt status, there must be a concurrence of ownership and use. The parcel must be used for the specified purpose for which the institution was organized. Additionally, some properties have to reapply every three years; February 1, 2028 is the next reapplication date.

At a minimum, the applicant must complete an application and provide proof to establish the eligibility for exemption. This may include:

- Articles of incorporation

- Copies of deeds

- Explanation of use of the property

- Income tax returns

- Proof of 501(c)(3) status

Certain entities may need to supply additional documentation.

Applications

Choose one of the following three common property tax exemption types for the appropriate application. Please contact the Assessor’s Office at (507) 725-5801 for more information or for assistance completing the correct application.

- Institutions of Purely Public Charity Property

- Nursing Home and Boarding Care Home Property

- General Exempt Property

Granting Property Tax Exemptions

Exemption from property taxes may be granted by the County Assessor after all required information and an application has been submitted. The Assessor will be in contact with the applicant throughout the process and will ultimately issue a determination on the exemption.

Initial applications for exemption are due February 1 of the year the exemption is first sought if the property was owned and used for exempt purposes on January 2 of that year. Reapplications for already-exempt property are also due February 1 of the reapplication year.

Property that was taxable on January 2 may become eligible for certain types of exemption after that date if the property was purchased after January 2 but before July 1.

When a property is granted exemption for an assessment year, it is generally in effect starting with taxes payable in the following year. For example, if a property is granted exemption for the January 2, 2026 assessment, it will be exempt from property taxes that would normally be paid in 2027.

Contact the Assessor’s Office at (507) 725-5801 for an application, or for more information.

State-Assessed Property

Taxes on Land Used for Specific Purposes

There is some property in Houston County that pays property taxes like other properties, however its value may be determined by the State of Minnesota. State law requires Minnesota’s Department of Revenue to value and/or tax the following property:

- Air flight property (certain airplanes and equipment)

- Certain pipelines and utility property

- Operating railroad property (active railroad tracks and buildings)

- Wind energy conversion systems (turbines that produce energy)

- Solar energy production systems (solar panels and arrays)

Most of this property is valued in a somewhat different process than the way the assessor’s office determines market value for the property in Houston County. These properties valued by the State are usually multi-state or national companies and they are valued as such. Then a portion of that value is attributed to Minnesota and a portion of the State’s value is attributed to our County. The Department of Revenue provides us with the values and we apply them in our system so those property owners pay property taxes similar to every other taxpayer.

A Special Note on Wind Energy Conversion Systems

The State of Minnesota determines a tax for owners of certain wind energy conversion systems based on the amount of potential energy production. If the system is over 0.25 megawatts (or two megawatts and owned by the government), it pays this production tax.

For wind energy conversion systems, the County Assessor’s office still values and imposes a tax on the land underneath the system. The value of that land would be similar to the rate at which other similarly-used land is valued.

A Special Note on Solar Energy Production Systems

The State of Minnesota determines a tax for owners of certain solar energy production systems based on the amount of potential energy production. If the system is over 1.00 megawatts, it pays this production tax. Systems smaller than this size do not pay the production tax.

For solar energy systems, the County Assessor’s office still values and imposes a tax on the land underneath the system. The value of that land is typically similar to the rate at which other similarly-used land is valued.

Mobile/Manufactured Homes

How is a mobile/manufactured home assessed and taxed today?

A mobile/manufactured home is assessed as of January 2. There are two classifications of mobile/manufactured homes: real property and personal property.

REAL property is a mobile/manufactured home that sits on property owned by the mobile/manufactured home owner.

PERSONAL property is a mobile/manufactured home that sits on land ‘not’ owned by the owner of the mobile/manufactured home.

Is the taxation of a mobile/manufactured home classified as personal property the same as it is for real property?

Yes, for the most part.

REAL property (as defined above) is assessed as of January 2 of the present year and taxed the following year. Owners are sent a Real Property Tax Statement.

PERSONAL property (as defined above) is assessed as of January 2 of the present year and taxed in the same year. The title holder is sent a Personal Property Tax Statement.

When are the tax bills issued and the tax payments due on a mobile/manufactured home?

REAL property tax statements are mailed on or before March 31st of each year.

- First half of payment is due May 15th

- Second half of payment is due Oct 15th

PERSONAL property tax statements are mailed on or before July 15th of each year.

- First half of payment is due Aug 15th

- Second half of payment is due Nov 15th

- If the total bill is less than $50, then the full amount is due on Aug 15th

If a mobile/manufactured home is sold, what is the seller or buyer required to do?

The buyer and seller are responsible to transfer the certificate of title at the county Department of Motor Vehicles. Before the transfer of ownership, the following requirements must be met: (1) all past and current taxes due are paid and (2) a current certificate of title with any required lien releases must be submitted. The seller should inform the assessor about the change in ownership and complete a homestead application to receive the homestead deferral, if this is their principle residence.

What is a certificate of title?

The certificate of title is similar to the ‘Title’ of a motor vehicle. It will contain specific information about size of the mobile/manufactured home along with a Vehicle Identification Number (VIN).

How does one obtain a certificate of title?

The seller should have this document and complete the transferable portion when completing the sales transaction.

What can one do if a certificate of title cannot be found?

Like with a motor vehicle, if the title cannot be located a copy can be requested at the Department of Motor Vehicles (DMV).

How is a certificate of title transferred?

The title for a mobile/manufactured home is transferred the same as a motor vehicle. The certificate of title must be submitted to the DMV, with completed transferable information, to have the title placed in the buyer’s name.

Should the assessor be notified if a mobile/manufactured home has been bought or sold?

Yes, when a mobile/manufactured home has been bought or sold, the assessor should be notified of the ownership change. This is necessary to ensure that the new owner receives the tax bill and has an opportunity to file an application for homestead if it is their principal residence. If the assessor’s office is not notified of the ownership change, tax statements will continue to go to the seller.

If the mobile/manufactured home is to be moved by its owner or a professional mover, what is required before a permit can be issued?

If an owner is planning to relocate a mobile/manufactured home, the proper state, county, city, and township authorities should be contacted to obtain the required permit(s). Before a permit can be issued, the owner must obtain a tax clearance form from the auditor-treasurer in the county where the mobile/manufactured home is located. This form is issued to the owner only when all property taxes that are due or will become due have been paid. If a mobile/manufactured home is moved without the proper paperwork, the law allows for a fine to be imposed on the mover.

If you have any questions regarding this information, please contact us: 507-725-5801.

What is property tax?

How is property tax assessed?

How is property tax calculated?

What does the County Assessor's office do?

What is market value?

How are market values estimated?

When is the market value determined?

How are properties classified?

How often are properties viewed?

What information does the assessor gather?

What tools does the assessor use when determining value?

What is the annual sales study?

What is the role of the appraisers and what are their credentials?

What is property tax?

The tax is a government cost charged to a property owner based upon the property’s taxable estimated market value and classification. Counties, townships, cities, school districts, and a few miscellaneous taxing authorities levy taxes on real estate and some personal property to help pay for local services including road and bridge maintenance, community services, police and fire protections, libraries, parks, and education. The State also levies a general tax on commercial, industrial, and seasonal recreational residential properties.

How is property tax assessed?

Each property’s tax burden is determined according to its value, classification, and the local property tax levies. Assessors are responsible for estimating property values and determining property classifications.

How is property tax calculated?

Market values, budgets, property classification rates, and classification credits determine the property tax. The first step is to determine the tax capacity value by multiplying a property’s taxable market value by its classification rate. Step two is to establish a tax by multiplying the property’s tax capacity by the overall tax rate. The overall tax rate is a multiplier, resulting from the division of each district’s total levy by the district’s tax capacity value. The third and final step is to subtract any property tax credits from the preceding tax calculation to determine the net payable tax.

What does the county assessor’s office do?

The county assessor, along with the county appraisers on staff, estimate the market values and classify properties based on current use or most likely use of the property.

The assessor’s office also administers a number of land owner and special tax programs. These programs are listed and explained under the corresponding tabs to the left.

What is market value?

Market value can be defined as the highest price in terms of money which a property will bring in a competitive and open market under all conditions requisite to a fair sale, the buyer and seller, each acting prudently, knowledgeably, and assuming that neither is under undue duress.

How are market values estimated?

The law requires that appraisers view each parcel of real estate to appraise its market value based on current market conditions. In addition to current market, numerous physical changes affect the land and building values. These factors are considered when estimating the value of a property. This requires a physical inspection of all property subject to assessment within a five-year period or “quintile”.

When is the market value determined?

Minnesota state law requires that the value and classification of all real and personal property be established as of January 2nd of each year. The assessor's office works throughout the year to analyze property sales and economic conditions in order to estimate market value of properties for the following January 2nd assessment date.

Market values are included on the Valuation of Real Property Notice, which is mailed to each property owner March 31.

How are properties classified?

The assessor determines the classification of each property based on the current use of each parcel. There are multiple property classifications such as residential, commercial, agricultural, seasonal recreational residential, industrial, exempt, and rural vacant.

Agricultural and residential can be either homestead or non-homestead and some properties can fall under more than one classification. Each classification may be taxed at a different percentage of market value. These percentages are set by the Minnesota State Legislature and may change from year to year.

How often are properties viewed?

Each taxable property will be viewed by the assessor’s office staff once every five years. In addition, all new construction, alterations, or improvements are viewed in the current year.

What information does the assessor gather?

The assessor gathers information on all characteristics of the property that affect market value, such as size and age of the building, quality of construction, condition of the structure, and special features such as basement finish, fireplaces, walk-out basements, decks, etc. Characteristics about the land are also observed, such as location, number of acres of land, quality features of the land, as well as determining value of aspects such as water front footage along the Mississippi River.

What tools does the assessor use when determining value?

The Houston County Assessor's Office utilizes a computer-aided mass appraisal (CAMAVision) system which assists the assessor in achieving uniformity and equality during the assessment process.

What is the annual sales study?

According to state law, the estimated market value determined by the assessor, is supposed to represent 100% of real value as expressed in the real estate market. This is determined through annual sales studies that run from October 1 through September 30 each year.

The Minnesota Department of Revenue, through the State Board of Equalization, meets annually with the county assessor and through the use of statistical measures determines and reviews the overall quality and level of assessment by way of the sale study results.

The median ratio, of the estimated market values, for each class and jurisdiction, with at least six sales in that grouping, must be at 90-105%. If not, the overall values of the parcels within that classification and that jurisdiction must be adjusted, either higher or lower, so that it falls within the 95% to 105% range.

What is the role of the appraisers and what are their credentials?

The Houston County taxing districts hire the county assessor’s office to complete the assessment for them. All assessments are supervised from the county assessor's office, under the direction of the county assessor.

The staff appraisers employed by Houston County must adhere to training and experience requirements that are set by state statute. The State Board of Assessors governs and administers the licensing of ad valorem property assessors. Houston County recognizes five separate titles for its property assessors.

- Appraiser Trainee has not completed the first level of course work and one year of experience.

- Certified Minnesota Assessor, CMA (non-income qualified), has successfully completed the necessary course work and one year of experience. This position is granted by the State of Minnesota.

- Certified Minnesota Assessor, CMA (income qualified), has achieved the CMA non-income qualified and successfully completed the additional course work and experience. This position is granted by the State of Minnesota.

- Accredited Minnesota Assessor, AMA, has achieved the CMA income qualified and successfully completed the additional course work, written and received a passing grade on a residential form report, has acquired three years’ experience and has passed the required eight-hour exam. This position is granted by the State of Minnesota.

- Senior Accredited Minnesota Assessor, SAMA, has achieved the AMA, has no less than five years’ experience, has passed an additional eight-hour exam, and has successfully completed an interview in front of the Minnesota Board of Assessor’s. This is the level necessary to become a County Assessor.

Contact Us

The Houston County Assessor’s Office is open Monday–Friday 8:00am–4:30pm. Please email, call, or stop into the office if you have any questions or concerns.

Houston County Assessor

304 S. Marshall Street, Room 203

Caledonia, MN 55921

Email

507-725-5801

Luke Onstad

Houston County Assessor

.

.

.

Assessor's Office

304 S. Marshall St.

Caledonia, MN 55921

P: 507-725-5801