The Auditor-Treasurer receives payment of all current and delinquent property taxes. This department also calculates the tax rates, prepares the Truth in Taxation Notices and Property Tax Statements. This department handles all information regarding land transfers, elections and business license.

- The Auditor-Treasurer calculates tax rates and taxes due based on the levy request submitted by the county, cities, school districts and special taxing districts. After payment, apportions and disburses the proceeds to the various governmental subdivisions.

- Prepared the Truth in Taxation Notices and Property Tax Statements for every taxable real and personal property in Houston County.

- Maintains and collects property taxes and spreads the tax collections to the proper taxing district

- Works with tax credits and special tax deferments

- Maintains special assessments for cities and townships, applies the payments for collection and remits the annual installments to the proper taxing district

- Administers Tax increment Financing as it pertains to tax calculation

- Conducts Tax Forfeiture Land Sales on behalf of the county

- Maintains the tax roll through updates to ownership, splits, transfers and the combining parcel process

- Chief Elections Administrator for Houston County

- Serves as Deputy Registrar (License Center) for the county

- Processes liquor, auctioneer, transient merchants and peddlers license

- Acts as the bank and custodian of all County funds and cash assets

- Invest idle cash reserves into such banking instruments as CD’s (certificate of deposit) and Money Market (savings account)

- The department is required by law to maintain a set of records for all funds received and expended. Similar records are kept by the Houston County Finance Department. This provides a system of checks and balances necessary in all financial administration.

- The Auditor-Treasurer is elected by the citizens of Houston County to serve a four year term

- Send Tax Payments by mail (including tax stub(s) to:

Houston County Auditor-Treasurer

304 S. Marshall St. Room 112

Caledonia MN 55921 - Pay Taxes On-Line

- To pay by credit/debit, a 2.5% convenience fee will apply

- To pay be eCheck, a $1.50 convenience fee will apply

- Direct Payment Signup Form (ACH)

- Payment Box:

- Located at front door of Historic Courthouse at 304 S. Marshall St. in Caledonia (door facing the west)

- Please ensure your payment (check or money order made payable to Houston County Auditor-Treasurer) is clearly marked on outside of envelope with ‘Auditor-Treasurer’. The tax stub(s) should also be included with payment.

- Pay in Person:

- To pay in person, our office hours are 8 AM – 4:30 PM Monday – Friday

- Please bring in your tax stub to:

Historic Courthouse – Room 112

304 S. Marshall St.

Caledonia MN 55921

- Please bring in your tax stub to:

- To pay in person, our office hours are 8 AM – 4:30 PM Monday – Friday

- Parcel Search & GIS Information

- When are taxes due?

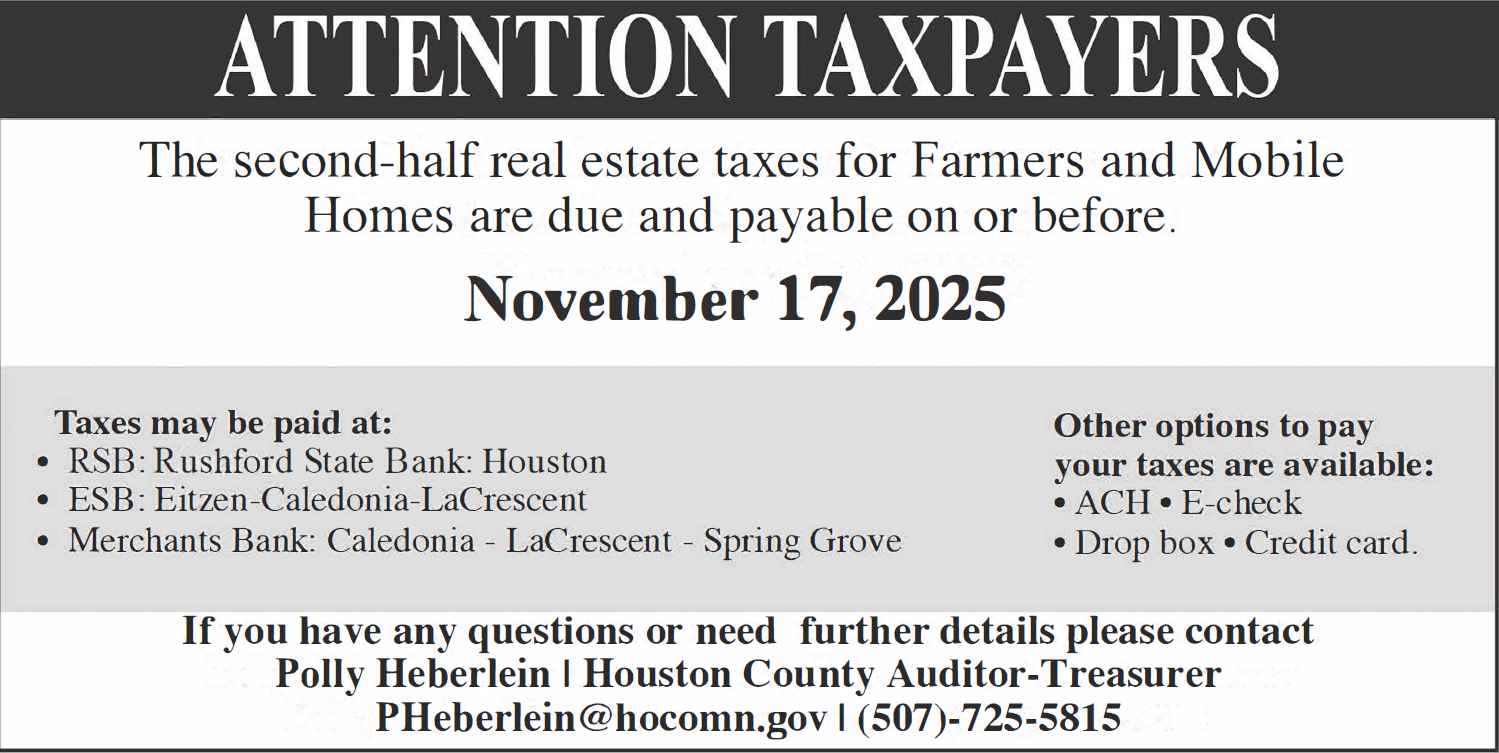

- Real Estate and Personal Property: First ½ due May 15th

- Real Estate and Personal Property: Second ½ due October 15th

- Property classed as Agricultural: First ½ due May 15th

- Property classed as Agricultural: Second ½ due November 15th

- Manufactured Homes: First ½ due August 31st

- Manufactured Homes: Second ½ due November 15th

- Please check the due dates printed on your tax statements

How do I calculate the penalty for a late tax payment?

On the back of your tax statement is a ‘Schedule of Penalties for late Payment of Property Tax’. The penalty rate changes on the day after due dates and the first day of every month. The schedule is complex and confusing: if you have any questions, please call the Auditor-Treasurer’s office at 507-725-5815

My property tax estimated market value is wrong: who can help me?

The Houston county Assessor’s office will assist you in determining the correct estimated market value. (507) 725-5801

Where do I change my Homestead status?

The office of the Houston County Assessor maintains all Homestead applications. Forms may be obtained by phone at (507) 725-5801

How do I change the owner’s name on my tax statement?

Real Estate Tax: A legal document transferring ownership of the property must be recorded in the Houston County Recorder’s office. It is advisable that the document be prepared by an attorney to ensure proper form and legality.

Manufactured Home Tax: A photo copy of the Certificate of Title with the new owner’s name must be sent to the Houston County Assessor’s office.

How do I remove my deceased spouse’s name from my tax statement?

Real Estate: A legal document such as an Affidavit of Survivorship or a document transferring ownership of the property must be recorder in the Houston Count Recorder’s office. A death certificate will not work. It is advisable that the document be prepared by an attorney to ensure proper form and legality.

Manufactured Homes: You must apply for a new Certificate of Title from a Deputy Registrar for MN Dept. of Motor Vehicle and present a photocopy of the new title to the Houston County Assessor’s office. The sellers name must remain on the tax rolls until the County receives the new title.

How are state Deed and Mortgage Registry taxes calculated?

State Deed tax is the selling price X .0033, or a fraction thereof, or total consideration conveyed by the deed. The seller is legally responsible for paying the deed tax. The deed tax is due upon the execution and delivery of the deed, not the recording.

Mortgage Registration tax is the selling price X .0023, or fraction thereof, of the principal debt which is secured by the mortgage. The MRT is to be imposed on the recording of the document. The MRT laws do not specifically address the question of who is legally responsible for paying the MRT. However, the laws are clear that a mortgage cannot be recorded until the MRT is paid.

Where can I get the dimension of my property? How can I tell where my property lines are?

The tax rolls contain summary descriptions of the property: complete legal descriptions should be obtained from the latest recorded deed.

It may be necessary for you to contract with a private surveyor to determine the actual property lines of your property. Houston County does not have surveys of all parcels in the county.

The Houston County Assessor’s office has detailed information on all property in the county including acreage, property dimensions, building square footage, type of construction, etc.

Where do I get a copy of my deed?

The Houston County Recorder’s office. (507) 725-5813

The amount of taxes on a certain piece of property?

Check this website, from the home page click on Property Search

Is tax information available on our website?

Yes, from this website’s home page, click on Property Search

Houston County Newspaper Bid Form

Official Newspaper Advertisement

Tax Supplemental Budget Information

Township - ISD 238

Township - ISD 239

Township - ISD 294

Township - ISD 297 (1)

Township - ISD 297 (2)

Township - ISD 299

Township - ISD 300

City of Houston - ISD 294

City of Spring Grove - ISD 297

City of Brownsville - ISD 299

City of Caledonia - ISD 299

City of Eitzen - ISD 299

City of Brownsville - ISD 300

City of La Crescent - ISD 300

To apply for a Passport or Renew a Passport, visit the Auditor-Treasurers Office in the Historic Courthouse at 304 S. Marshall St. in Caledonia– Room 112 – 1st Floor

To obtain a Passport Photo, visit the Recorders Office in the Historic Courthouse in the Historic Courthouse at 304 S. Marshall St. in Caledonia – Room 111 – 1st Floor

Items to bring along when applying for a Passport in person: (for most common types of requests)

- Valid Drivers License

- Certified Birth Certificate (not the one the hospital issues)

- At least three check blanks

Please bring Marriage License (in addition to the items listed above) if the name on Drivers License is still in maiden name and you are requesting the Passport to be issued in your married name

For additional information, visit the links below:

Auctioneer License

Minnesota Statute 330 requires that auctioneers in the state of Minnesota be licensed. Application for an auctioneer license is made in Houston County. Licenses are valid for one year.

- Resident – Visit the Auditor-Treasurer’s Office in the Historic Courthouse – Room 116 – First Floor or call 507-725-5803 for more information

- Non-Resident – Visit the Auditor-Treasurer’s Office in the Historic Courthouse – Room 116 – First Floor or call 507-725-5803 for more information

Canvasser/Solicitor License (30 day)

A canvasser or solicitor includes any person going from place to place taking or attempting to take orders for sale of goods or services for future delivery. This will not apply to salespeople who solicit orders from or sell to retail dealers for resale or to manufacturers for manufacturing purposes or to bidders for public works or supplies. A canvasser or solicitor also includes any person going from place to place requesting financial assistance of any kind for charitable, political, religious or other causes.

Visit the Auditor-Treasurer’s Office in the Historic Courthouse – Room 116 – First Floor or call 507-725-5803 for more information

Gambling Permit

Permits to hold fundraising events by non-profit groups in Townships of Houston County are issued by the Minnesota Gambling Control Board. More information can be found at the MN Gambling Control Board web site and the forms are provided on the Gambling Permit and Other Forms page of the web site.

Before submitting your application to the MN Gambling Control Board, the application must be acknowledged and signed by Houston County. You may submit in person or by mail to:

Houston County Auditor-Treasurer's Office

Attn: Gambling Permit

304 S. Marshall St.

Caledonia MN55921

Visit the Auditor-Treasurer’s Office in the Historic Courthouse – Room 116 – First Floor or call 507-725-5803 for more information

Liquor License

Houston County offers several different liquor licenses for establishments outside city limits.Establishments within city limits must apply to the municipal clerk in the city.

Houston County must approve and recommend the License Application to the Alcohol and Gambling Enforcement Division.Depending on the license, the complete time frame from application to approval and license could take 8-12 week.

Visit the Auditor-Treasurer’s Office in the Historic Courthouse – Room 116 – First Floor or call 507-725-5803 for more information

Peddler (30 day) License

A peddler is a canvasser, solicitor or traveling vendor who goes from house to house or street to street selling goods or merchandise he carries with him.

Visit the Auditor-Treasurer’s Office in the Historic Courthouse – Room 116 – First Floor or call 507-725-5803

Tobacco License

Houston County issues tobacco licenses for all Townships and Cities within the county.

Visit the Auditor-Treasurer’s Office in the Historic Courthouse – Room 116 – First Floor or call 507-725-5803 for more information

Transient Merchant License(7 day)

Anyone who engages in any temporary or transient business, locally or traveling place to place, within Houston County is required to obtain a Transient Merchant License.

The term "transient merchant" does not include a seller or exhibitor in a firearms collector show involving two or more sellers or exhibitors.

The license is valid at one sale location only and not valid for more than one person, unless that person is a member of a co-partnership. The license is only valid in Houston County.

Visit the Auditor-Treasurer’s Office in the Historic Courthouse – Room 116 – First Floor or call 507-725-5803 for more information

Fireworks Permit

Visit the Sheriff’s Office in the Justice Center -First Floor or call 507-725-3379 for more information.

For Small Business Licenses, visit this website.

Guidelines for combining parcels:

- Parcels must be in the same section, township, range and school district

- The parcels must have identical ownership titles

- The parcels must have been previously transferred on the same type of documents

Ex: both parcels were transferred on Warranty Deeds or both on Quit Claim Deeds but can not be on one of each. - There can be no delinquent taxes on any of the parcels involved

Splitting Parcels Form

Forfeited Tax Sales

Notice of Expiration of Redemption

Final Stage of Tax Delinquency

- County Auditor-Treasurer files the Expiration of Redemption with the County Recorder

- The parcel is removed from the tax roll and the parcel forfeits to the state in trust for the local taxing districts

- County Auditor-Treasurer cancels all property tax and special assessments on the parcel

- County Board of Commissioners classifies the property, appraises the parcel and sets the terms and date of the Tax Forfeiture Land Sale

- Department of Revenue approves the classification and sale of the property

- Upon completion of the sale, the state issues a State Deed to the purchaser

- County Auditor-Treasurer deposits the revenue from the sale and distributes the net proceeds to the taxing districts

Voter Registration

Am I eligible to vote?

You are eligible to vote in Minnesota if you are:

- A U.S. Citizen

- At least 18 years old on Election Day

- A resident of Minnesota for 20 days

- Not currently incarcerated for a felony conviction

- Not under a court order that revokes your right to vote

Register Online or Update your Voter Registration here: https://mnvotes.sos.mn.gov/VoterRegistration/index

Or register in-person with the Houston County Auditor-Treasurers Office at 304. S Marshall S, Room 116 in Caledonia. Office hours are 8AM -4:30PM Monday-Friday.

A paper voter registration application can be found here: https://www.sos.state.mn.us/elections-voting/register-to-vote/register-on-paper/

For more information on Voter Registration: https://www.sos.state.mn.us/elections-voting/register-to-vote

Absentee Voting

To vote by absentee, you must first submit an absentee ballot application.

You can vote absentee by mail or in-person.

Apply Online: Applications can be made online here: https://mnvotes.sos.mn.gov/abrequest/index

Apply In-Person: Visit the Auditor-Treasurer’s Office (Room 116) located at 304 S. Marshall St in Caledonia.

Apply By Mail: Applications can be submitted by mail by downloading the Absentee Application here: https://www.sos.state.mn.us/media/2444/english-regular-absentee-ballot-application.pdf

Paper application forms can also be mailed to you on request.

Call 507-725-5803 for any questions on voting by absentee.

Reminder: Absentee Ballots Must Be Returned To The Auditor-Treasurer By 8:00 PM On Election Day To Be Counted.

2024 Primary Election Ballot Board Schedule

Elections

The Auditor-Treasurers Office administers Federal, State, and County elections for Houston County. These duties include the maintenance of voter records, candidate filing, election judge training, conducting absentee voting, tabulating election results, and conducting canvassing of the results.

Houston County to conduct postelection review of election results

On November 18, 2024, Houston County officials will conduct postelection reviews of election results to boost transparency in the election system. Minnesota counties are required to administer a postelection review between 11 and 18 days after each general election to confirm the accuracy of results ahead of the state certification. These events are open to members of the public. The review is a hand count of the ballots for specific offices in select precincts.

The postelection review for La Crescent P1 and Money Creek Township will be held on Nov. 18, 2024 beginning at 9:00 am. in Room B11 in the Houston County Historic Courthouse.

Post-election reviews are one layer of security to ensure our elections are free, fair, secure, and accurate. In each county, a certain number of precincts are randomly selected at the county canvass. The ballots from those precincts are then hand counted to make sure that the results the voting machines reported on Election Day are an accurate reflection of the marked ballots. Results must meet the acceptable performance standards outlined in statute; otherwise, additional precincts must be reviewed.

UPCOMING ELECTION DATES:

ISD 239 Rushford-Peterson School will have a Special Election on February 10th, 2026

- RP Absentee Voting Notice 2026

- For more information, please visit the schools Referendum Website

Other Key Election Dates:

- February 6th, 2026 - Absentee Voting Begins for Township Election

- March 10th, 2026 - March Township Election

- June 26th, 2026 – Absentee Voting Begins for Primary

- August 5th, 2026 – Public Accuracy Test @9:00am

- August 11th, 2026 - State Primary Election

- September 18th, 2026 – Absentee Voting Begins for General

- October 28th, 2026 – Public Accuracy Test @9:00am

- November 3rd, 2026 - State General Election

ELECTION NOTICES

Website Township Election Notice 2026

Website Township Election Notice 2025

Location-Times of Township Elections 2026

Public Notice 2025 New Voting System

Court Order to Correct Ballot Printing Error - 2024 General Election

Notice of Ballot Errors and Omissions

Notice of Election (link to doc when it is available)

NOTICE OF PUBLIC ACCURACY TEST

Notice is hereby given that the public accuracy test of the election equipment to be used in the August 13, 2024, State Primary Election will be held in the Commissioners Room 222, Houston County Courthouse, 304 South Marshall Street, Caledonia, MN, at 10:00 a.m. on Wednesday, August 7, 2024.

By: Polly Heberlein

Houston County Interim

Auditor/Treasurer

ELECTION JUDGE TRAINING and Application:

Please call the Auditor’s Office at 507-725-5803 to schedule Election Judge Training.

Houston County Election Judge (Ballot Board) Application

WHERE TO VOTE?

Locate your polling place and precinct information here: https://pollfinder.sos.state.mn.us/

Or See listing of Houston County Polling Locations.

For March Township Polling Locations (Link to Township Election Polling Place Info Doc)

ELECTION RESULTS

To view Election Results visit: https://www.sos.state.mn.us/elections-voting/election-results

The Auditor-Treasurers Office uploads the Election Results to the Secretary of State’s website. Election Results are posted on election night.

SAMPLE BALLOT

To view your sample ballot for an upcoming, go here: https://myballotmn.sos.mn.gov/

Or request a copy by contacting 507-725-5803

TOWNSHIP ELECTIONS

The next township election is scheduled for March 11, 2025.

CAUCUS INFORMATION - 2026

Next Caucus: 02/03/2026 GUBERNATORIAL PREFERENCE BALLOT

Caledonia City Auditorium[Map]

219 E Main St

Caledonia MN 55921

LaCrescent-Hokah High School - Cafeteria[Map]

1301 Lancer Blvd

LaCrescent MN 55947

Caucus location information is provided by the major political parties and may continue to be added or updated. If your caucus location is not displayed or is incorrect, notify the political party.

Minor political parties are not required to hold caucuses on the established caucus date or provide location information to the state. For minor political party caucus information, contact the political party.

To Find your Party Caucus Location visit: https://caucusfinder.sos.mn.gov/

The next statewide caucus will be held February 3, 2026.

MILITARY AND OVERSEAS VOTER’S

Register here (https://mnvotes.sos.mn.gov/uocava/index)

Military and Overseas Voters Register Here

FOR MORE ELECTION INFORMATION

Visit the Secretary of State’s Website for more information on voting, election processes, and election results.

TERMS AND CONDITIONS ARE AS FOLLOWS:

PUBLIC SALES:

All tax forfeited land will be offered at a public sale and sold to the highest bidder. The minimum bid acceptable is the basic sale price that is shown on the list of tax-forfeited land.

TERMS:

All sales shall be for “Cash, Check, Money Order, or Credit Card (2.50% convenience fee), Day of Sale”. All sales are final and no provisions will be made for a refund or exchange. Checks will be made payable to “Houston County Treasurer”.

OTHER CHARGES (PAYMENT MADE AT TIME OF SALE):

- State Deed charge of $25 per deed.

- State Assurance Fund – 3% of the purchase price.

- State Deed Tax. The tax is based on the amount of the sale at the rate of $3.30 for each $1,000, with a minimum of $1.65.

- $46 Recording Fee per deed.

- $50 Fee if well certificate is needed.

CONDITIONS: RESTRICTIONS ON THE USE OF THE PROPERTIES

Sales are subject to the following restrictions on the use of the properties:

- Existing leases;

- Easements obtained by a governmental subdivision or state agency for a public purpose;

- Building codes and zoning laws;

- All sales are final with no refunds or exchanges allowed;

- The appraised value does not represent a basis for future taxes; and

- Buyer is purchasing property “AS IS”

SPECIAL ASSESSMENTS: LEVIED BEFORE AND AFTER FORFEITURE

The balance of any special assessments that were levied before forfeiture and canceled at forfeiture are not included in the basic sale price and may be reassessed by the municipality. These special assessments are shown on the list of tax forfeited land under the column entitled “Special Assessments Subject to Reassessment.”

Local improvement constructed, but not yet assessed, must be assumed by the purchaser.

IMPORTANT: To find out if a particular tax forfeited parcel may be assessed or re-assessed please contact the local municipality the parcel is located in.

PROHIBITED PURCHASERS:

The County Auditor per MN Statute 282.016 has the authority to prohibit a person or entity from purchasing a tax forfeited property if that person or entity owns property within the county for which there are delinquent taxes owing.

STRAW BUYERS:

Straw buyers are prohibited from purchasing or bidding on a tax forfeited property for the previous owner as described in MN Statute 282.241 for an amount less than the sum of all delinquent taxes and assessments computed under MN Statute 282.251, together with penalties, interest, and costs, that accrued or would have accrued if the parcel of land had not forfeited to the state.

TITLE:

The buyer will receive a receipt at the time of sale.

The Department of Revenue will issue a state quitclaim deed after full payment is made. A state deed has the characteristics of a patent from the State of Minnesota.

BOUNDARIES:

Houston County is not responsible for locating boundaries on Tax Forfeited Lands.

RADON WARNING STATEMENT

The Minnesota Department of Health strongly recommends that ALL homebuyers have an indoor radon test performed prior to purchase or taking occupancy and recommends having the radon levels mitigated if elevated radon concentrations are found. Elevated radon concentrations can easily be reduced by a qualified, certified or licensed, if applicable, radon mitigator.

Every buyer of any interest in residential real property is notified that the property may present exposure to dangerous levels of indoor radon gas that may place the occupants at risk of developing radon-induced lung cancer. Radon, a Class A human carcinogen, is the leading cause of lung cancer in nonsmokers and the second leading cause overall. The seller of any interest in residential real property is required to provide the buyer with any information on radon test results of the dwelling.

Houston County is not aware of any radon testing conducted on any of these properties. No radon records are available and radon concentration levels are unknown. It is not known if a radon mitigation system is in place on any of the properties.

PRIVATE SALES: PARCELS NOT SOLD AT PUBLIC AUCTION

Any parcel not sold at a public sale may be purchased after the sale by paying the basic sale price plus other charges. The basic sale price cannot be changed until the parcel is reappraised, republished, and again offered at a later public sale.

SALE INFORMATION CAN BE OBTAINED FROM:

Houston County Auditor/Treasurer Office, 304 S. Marshall St., Caledonia, MN 55921

Phone: 507-725-5803

Email: auditor@co.houston.mn.us

Website: co.houston.mn.us/departments/auditor-treasurer/

Information for Candidates:

2024 Notice of Filing for Federal, State, and County Offices

Search Filed Affidavits of Candidacy here: https://candidates.sos.mn.gov/

For More information on Filing: Call 507-725-5803

Campaign Finance Reports

2024

2022

Campaign Finance Reports

Polly Heberlein

Houston County Auditor-Treasurer

.

.

.

Auditor-Treasurer's Office

304 S. Marshall St.

Caledonia, MN 55921

P: 507-725-5803

F: 507-725-2647